Only the Supreme Court could announce a bare minimum ethical guardrail that lower courts have used since the George W. Bush administration and act like it’s a bold blow against the appearance of impropriety.

The Supreme Court announced Tuesday that it will now employ software to help the justices identify when they should probably recuse themselves from cases. We say “probably,” because there’s still no actually enforceable ethics code binding Supreme Court justices and the Chief Justice has made very clear that he will ignore any attempt to impose one. Instead, the Supreme Court drafted a 14-page pinky swear that they will follow some of the same rules that bind lower court judges. According to this toothless document, the justices aren’t supposed to hear matters where they have direct financial stakes in the parties. Thus, this new software package and a tweak to the filing rules to require parties include their stock ticker symbols.

To be clear, lower court judges have been using conflict-checking software since 2007. The Supreme Court first hinted that it might start using conflict-checking software in 2023. After that, the Court went silent and just continued running its recusal process with all the organization and transparency of the worst owner in your fantasy football league on draft day.

Eight hundred and twenty-seven days later: mission accomplished!

Gabe Roth of Fix the Court put a fine point on the situation:

Per their most recent disclosures, only two justices, Chief Justice Roberts and Justice Alito, own individual stocks, with the former holding shares in two companies and the latter holding shares in more than two dozen. So although the new rule is a net positive since it comes in service of the full Court’s adoption of conflict-check software, it’s not a major improvement, and it should not have taken 827 days post-Code to implement. That’s especially true since lower court judges have been required to use software-based conflict screening for 20 years, and several justices have been rumored to continue to use it after they were elevated.

Justice Alito’s stock portfolio has become a recurring subplot in the Court’s ongoing ethics drama. Just last month, Alito recused himself — right before oral arguments — from the high-profile Chevron USA v. Plaquemines Parish case because of his holdings in ConocoPhillips, whose subsidiary Burlington Resources remained a party in the lower court proceedings. Alito holds stock in more than two dozen companies and accounts for roughly a third of all recusals at the Court. Chief Justice Roberts holds stock in two companies.

Meanwhile, the other seven justices have figured out how to manage their finances without being ethical drags upon the Court. The Supreme Court took over two years to institute a new software solution to fix a problem that exists solely because these two refuse to divest from the market as a small price to pay for being the nation’s SuperLegislature.

If the justices wanted to institute a more effective change related to their ethics and their investments, they’d agree as a Court not to hold any stocks during their tenures, since all it does is cause unnecessary recusals. An investor-justice could own a blended fund, mutual fund or ETF and reap the same benefits with a far reduced conflict exposure. In fact, seven of the nine justices have made this very calculation.

When Pete Rose got banned from baseball for gambling on games, one of the popular arguments people made in his defense was that he never bet against his team. He wasn’t throwing games or anything… he was just confident in himself! Except when he looked at the other dugout and decided to NOT bet on himself, that was a signal too. Note that Sam Alito owns ConocoPhillips and not “Happy Green Solar Farms.” And while it’s not an issue with the Court’s current 6-3 majority, if Alito thought his fossil fuel holdings might jeopardize a ruling in favor of polluters, he could adjust his portfolio accordingly. The fact that this is even possible is that appearance of impropriety.

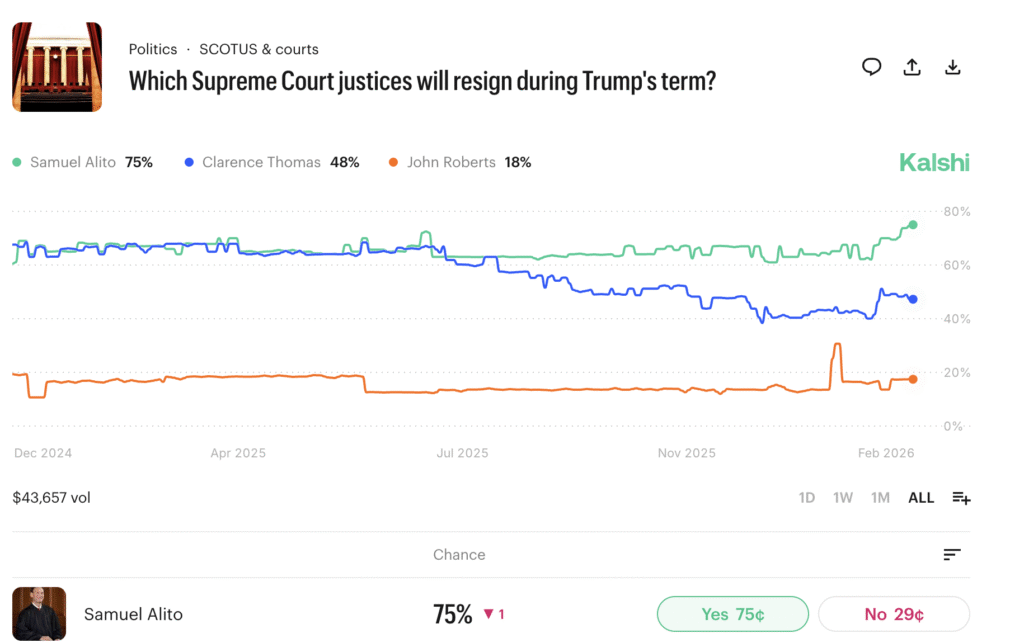

Speaking of gambling, our former Above the Law colleague Elie Mystal of The Nation recently speculated that Alito plans to retire at the end of this Term. Pointing to the announcement that Alito’s new book will drop right before the next Supreme Court Term, Elie sees a clear signal that Alito is planning to be on a book tour the next time the justices convene. Dahlia Lithwick and Mark Joseph Stern echoed this prediction over at Slate. Then it became full-blown conventional wisdom (though our other former Above the Law colleague David Lat has a counterargument). Over at we’re-not-a-gambling-site-except-in-the-way-that-we’re-totally-a-gambling-site Kalshi, you can trace Alito’s literal stock rising off Elie’s musings.

Is Sam Alito out there spamming that “No” contract preparing to reap the benefits in an epic bid to own the libs like Elie? Food for thought.

Back to the topic at hand. Given the unlikelihood of a voluntary selloff, Roth pointed to a legislative proposal to ban stock ownership for justices and lower court judges alike — the latter having their own well-documented ethical issues with investments. House Republicans have already watered down this proposal with loopholes.

Roth also flagged something that often gets lost in the polite coverage of Supreme Court procedural updates:

Public service also demands public input, and it’s a bit ridiculous that the Court can simply release new rules without a notice-and-comment period or opportunity for public views. It’s yet another example of the Court acting exceptionally in all the wrong ways.

In the Court’s defense, the majority seems hellbent on bending the rest of the government toward their state of exception. Other than the Federal Reserve — which the majority will go to comical lengths to protect — this Court seems perfectly comfortable with a dementia-addled president unilaterally rewriting the rules and regulations governing every executive agency. Why not impose Supreme Court rule changes by imperial decree?

Anyway… the Supreme Court has a new ethics process. Don’t get too excited.

Joe Patrice is a senior editor at Above the Law and co-host of Thinking Like A Lawyer. Feel free to email any tips, questions, or comments. Follow him on Twitter or Bluesky if you’re interested in law, politics, and a healthy dose of college sports news. Joe also serves as a Managing Director at RPN Executive Search.

Joe Patrice is a senior editor at Above the Law and co-host of Thinking Like A Lawyer. Feel free to email any tips, questions, or comments. Follow him on Twitter or Bluesky if you’re interested in law, politics, and a healthy dose of college sports news. Joe also serves as a Managing Director at RPN Executive Search.

The post Supreme Court Adopts ‘New’ Process To Avoid Conflicts Of Interest 20 Years Too Late appeared first on Above the Law.