The law practice management platform MyCase rolled out three product updates today that include MyCaseIQ, an AI conversational interface; enhancements to its accounting module; and an immigration add-on. It also announced the beta release of Smart Spend, a product that marries a business credit card to expense tracking within MyCase.

Generative AI Enhancements

Last January, AffiniPay, the parent company of MyCase, announced AffiniPay IQ, its strategic initiative to embed generative artificial intelligence across all of its products and make AI a native component of legal professionals’ daily workflows, along with the beta versions of the first two features of that initiative, document summarization and text editing.

Now, those two features are coming out of beta under the name MyCase IQ. The text editing feature is already out of beta and available within MyCase, and document summarization will launch within a few weeks.

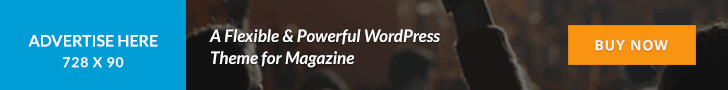

In addition, early next year, MyCase will release an AI-driven conversational interface will allow users to source case information, timelines, and data, all within the case file itself, by asking questions in a conversational style.

The interface will be embedded directly in the case detail page. It will have suggested prompts that users can select, such as to request a summary of the case or a detailed timeline.

“We are on a mission to make our clients financially well, and to use cutting edge technology to achieve that goal in partnership with them,” Dru Armstrong, chief executive officer of AffiniPay, parent company of MyCase, told me during a briefing yesterday.

“So our whole thesis for generative AI is to not do it because everyone’s doing it, but to do it because it makes firms be able to leverage automation and intelligence to give them time back so they can serve their clients.”

From beta testing these generative AI features, Armstrong said, one major takeaway has been that attorneys really need to trust the accuracy of the information the AI is providing.

“So we’ve done a lot of work to make sure that everything that goes full GA [general availability] meets those very high standards that our attorneys have,” she said.

Accounting Enhancements

MyCase also today introduced enhancements to its native accounting software. Among these enhancements:

- 1099 vendor reporting: To help simplify bookkeeping, MyCase Accounting will soon offer 1099 vendor reporting directly within the platform.

- Automatic deposit slip creation: MyCase accounting now offers automatic deposit slip creation for vendors. When funds are deposited into the firm’s bank account, the slip is created automatically.

- Automatic bank reconciliation: Once the deposit slip is created, it is matched to the corresponding bank feed transaction from LawPay, eliminating the sometimes time-consuming task of reconciling deposit slips and transactions.

The deposit slip feature is available now, and the other enhancements will be rolled out between now and the first quarter of next year.

Armstrong said the bank reconciliation is particularly powerful for its ability to solve a core practice management challenge of IOLTA compliance by combining invoicing within MyCase, electronic payments via LawPay, which is also owned by AffiniPay, and automatic reconciliation within the native accounting feature.

“When you have MyCase with the invoice and billing engine combined with LawPay, and then having the legal accounting package built natively in the platform, it really makes it a pretty automagical experience to be able to reconcile the invoices with the transactions with the bank account,” she said.

Immigration Add-On

The immigration add-on uses an application programming interface (API) to connect MyCase with its sibling company Docketwise, a case management platform for immigration lawyers.

The add-on integrates immigration case management into the MyCase practice management platform, enabling immigration attorneys to get the benefits of both case management and practice management without having to switch between platforms.

Armstrong said that many immigration customers wanted more of a full practice management platform, while keeping the immigration-specific case management features of Docketwise, such as its Smart Forms.

Ever since AffiniPay acquired MyCase, which already owned Docketwise, bringing together the capabilities of the two platforms “had been a core part of our vision,” Armstrong said.

To take advantage of the integration, MyCase users will required to purchase a subscription for the Docketwise add-on. The monthly cost of the add-on will be $79 per user or $69 if purchased annually.

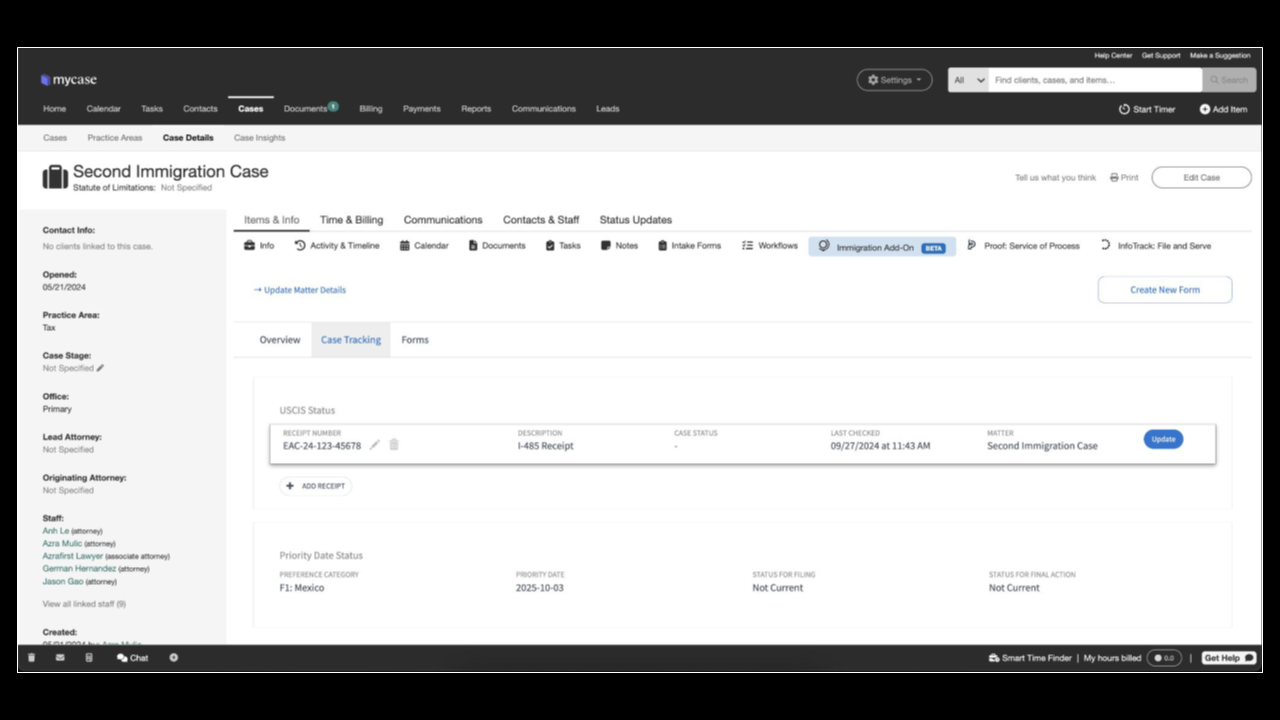

Once purchased, all Docketwise features will be available directly within MyCase, without having to switch platforms or even ever use the Docketwise platform. Among the features the add-on provides:

- Smart Forms: Users can auto-populate immigration forms with client data, eliminating manual entry.

- USCIS case tracking: Track the status of immigration cases through automatic USCIS updates, keeping attorneys and clients informed, from within MyCase.

- E-filing: Enables electronic submission of immigration forms directly to government agencies (USCIS, DOL FLAG, DOS CEAC) from within MyCase.

- Priority date tracking: Monitors key dates to ensure timely actions are taken on immigration cases, minimizing the risk of missed deadlines.

The immigration add-on is being soft-launched before the end of the year and will be made generally available to all users sometime next year.

Smart Spend Beta

MyCase also said today that the Smart Spend feature it announced last February will become available for beta testing by select customers staring Oct. 21. It will be released for general availability in the first quarter of next year.

MyCase had initially said it would be released in beta in the second quarter of this year and then to general release in the third quarter.

The Smart Spend feature promises to offer a business credit card for law firms that is tied to software that directly channels client-related expenses into the associated matters and invoices within the MyCase platform.

It provides law firms with a LawPay-branded Visa credit card for their attorneys and staff. All spending on the card is tracked to a dashboard where the firm can monitor all of its business and client expenses.

Spending is also integrated within MyCase, so client expenses are directly tracked to the matter, including the nature and category of the expense and any associated receipts.

‘Big Moves’ Ahead

In July, it was announced that Genstar Capital had made a significant investment in AffiniPay, while TA Associates, which had been the company’s largest investor since 2020, would continue to retain a “meaningful stake” in the company.

During our briefing yesterday, Armstrong said that she was “super excited” about the new investor, which now owns the larger share of the company.

“They’re a phenomenal software investor with just an amazing track record of helping build best-in-class, high-growth software businesses,” she said.

She said the driving force behind the deal was to be able to invest more in product research and development in order to deliver more for the company’s customers.

“It’s giving us an opportunity to think more strategically about our position in the market,” Armstrong said.

“We were super successful with our MyCase acquisition, and I think you’re going to see us making some big moves, whether it’s in products that we’ve built or products that we’ve partnered with or products that we bought.”